When Will the Housing Market Crash in Florida? Predictions for 2025 and 2026

- Ed DiMarco MS, MA

- Mar 28, 2025

- 11 min read

Discover expert predictions on when Florida's housing market might crash in 2025 or 2026.

Analysis of inventory trends, regional variations, and key factors affecting Florida real estate.

Florida's housing market has been a rollercoaster of extremes in recent years. After experiencing one of the nation's most dramatic price surges during the pandemic—with home values increasing by more than 50% between 2020 and 2022—the Sunshine State's real estate landscape shows signs of a significant shift. With inventory reaching decade-high levels, prices beginning to decline in many regions, and buyers gaining newfound leverage, many wonder: Is Florida headed for a housing market crash?

This comprehensive analysis examines the latest data, expert opinions, and market trends to clarify what homeowners, investors, and prospective buyers can expect from Florida's housing market in 2025 and beyond.

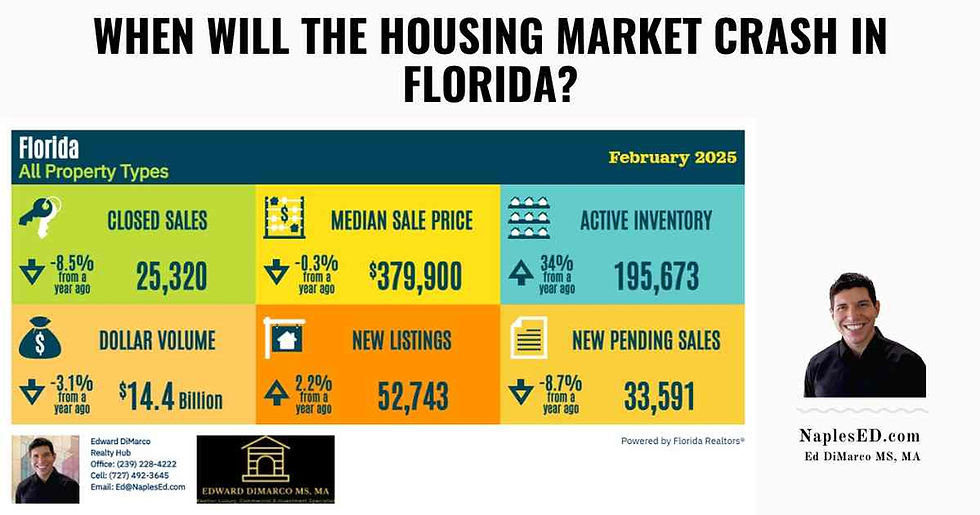

Current State of Florida's Housing Market

Florida's housing market is currently experiencing a pivotal transition after years of unprecedented growth. Recent data reveals several key indicators that suggest a market correction is underway:

Inventory Reaches Critical Milestone

According to Mike Simonsen, president and founder of Altos Research, the single-family home inventory in Florida has reached its highest level in a decade and is "still climbing. " The latest data shows single-family inventory up by 37.6% in 2025 compared to 2024—among the biggest increases in the country and significantly higher than the national average increase of 29%.

Florida is now among only eight states with higher inventory levels than in 2019 (pre-pandemic), with an 8.6% increase. According to Florida Realtors , over 360,000 single-family homes came onto the market in 2024 alone, representing a 9.5% increase from 2023.

Shifting Supply-Demand Balance

The supply-demand equilibrium in Florida has undergone a remarkable transformation. According to Dr. Brad O'Connor, Chief Economist at Florida Realtors, "If we go by the general rule of thumb that five to six months of supply is a balanced market, single-family homes ended 2024 still just barely in a seller's market at 4.7 months of supply, while condos and townhouses are now firmly in buyer's market territory, at 8.2 months' supply."

This shift is particularly pronounced in the condo market, where a new building-safety regulation requiring regular inspections and adequate HOA reserve funds has led to an explosion of listings in South Florida, as owners fear rising fees.

Price Trends Show Market Cooling

While Florida hasn't experienced a dramatic price collapse, there are clear signs of cooling:

The median sale price for single-family homes was $410,700 in Q4 2024, down 0.6% from Q4 2023 (Ramsey Solutions )

Condo prices are declining in 92% of Florida's housing markets (ResiClub Analytics )

Single-family home prices are falling in 66% of Florida's housing markets (ResiClub Analytics)

The average Florida home now spends 73 days on market before going under contract—14 days longer than a year earlier (Redfin )

Regional variations are significant, with some areas showing more resilience than others:

Orlando: $442,500 (up 1.4% year-over-year)

Tampa: $410,000 (down 1.2% year-over-year)

Jacksonville: $401,400 (up 2.9% year-over-year)

Miami: Expected to increase 4% in 2025, according to Zillow

Expert Predictions: Will Florida's Housing Market Crash in 2025?

Housing experts are divided on whether Florida will experience a full-blown crash or merely a correction, but most agree that significant changes are underway.

The Case for a Market Correction

A respected real estate analyst, Lance Lambert, notes that when "active listings start to rapidly increase as homes remain on the market for longer periods, it may indicate potential future pricing weakness." This pattern is precisely what Florida is experiencing now.

According to a recent Newsweek report, sellers in the Sunshine State increasingly have to meet buyers where they are, slashing their asking prices to make their properties more appealing in a less competitive market.

Tracey Ryniec, a value stock strategist at Zacks, was more direct in her assessment of specific Florida markets like The Villages: "They have priced themselves out of the market. Prices have to come down."

Some analysts predict that home values in specific Florida markets could drop by as much as 10% throughout 2025, particularly in areas that saw the most dramatic price increases during the pandemic boom.

The Case Against a Housing Crash

Despite concerning indicators, many experts believe Florida will avoid a catastrophic crash similar to 2008:

Tom Hutchens, executive vice president of production at Angel Oak Mortgage Solutions, argues that "the record low supply of houses on the market protects against a market crash." While Florida's inventory has increased, it hasn't reached the oversupply levels seen during the 2008 financial crisis.

Zillow remains optimistic about specific Florida markets, particularly Miami, where they predict prices will increase by 4% in 2025. Their VP of Research/Insights, Marta Rey Babarro, notes: "For Miami, we see in 2025 that the prices of homes will go up by 4%. So, homeowners will see that investment continue to go up."

Freddie Mac and the National Association of Realtors (NAR) predict modest home price growth nationally in 2025—Freddie Mac expects a 0.6% bump, while NAR expects as much as 2%. However, these national projections may not reflect Florida's unique market conditions.

The Consensus View: Correction, Not Crash

The most balanced assessment suggests Florida is experiencing a market correction rather than a crash. J.P. Morgan forecasts the housing market to remain "frozen" throughout 2025 with growth at 3% or less, while real estate analyst Mike Simonsen expects 2025 to be the last year of inventory shortage in the U.S.

Dr. Brad O'Connor of Florida Realtors summarizes the situation well: "Florida's housing sector is on the cusp of transitioning to a buyer's market." This transition is already underway in the condo market and is gradually extending to single-family homes.

5 Key Factors Driving Florida's Housing Market in 2025

Several critical factors will determine the trajectory of Florida's housing market in the coming year:

1. The Insurance Crisis

Perhaps no factor has more potential to trigger a market correction than Florida's insurance crisis. According to Ramsey Solutions, homeowner's insurance premiums in Florida have increased as much as 400% in just the last five years.

This dramatic rise in insurance costs makes homeownership financially untenable for many Floridians and deters potential buyers from other states. The insurance crisis is particularly acute in coastal and hurricane-prone areas, where some homeowners cannot find coverage at any price.

Brad O'Connor notes, "In 2024, several challenges weakened demand for housing in Florida, including the fact that mortgage rates remained elevated along with property insurance rates."

2. Inventory Surge

Florida's aggressive pace of new construction is flooding the market with inventory at a time when buyer demand is waning. According to Zillow, more single-family homes will enter the market in 2025 than we have seen in the last five decades.

This supply elasticity—Florida's ability to rapidly build new housing—is a double-edged sword. While it helps address long-term housing needs, it can lead to oversupply and price pressures in the short term, especially when combined with other market challenges.

ResiClub Analytics identifies this as a key vulnerability: "Unlike many housing markets in the Northeast and Midwest, Florida has a higher level of homebuilding and multifamily construction. As new supply enters the market in this affordability-strained environment, builders are using bigger affordability adjustments—such as mortgage rate buydowns—where needed."

3. Changing Migration Patterns

The pandemic-era migration boom that fueled Florida's housing market has significantly cooled. According to ResiClub Analytics, "Florida saw net domestic migration of +64K in 2024, compared to +314K in 2022."

This dramatic slowdown in migration means fewer deep-pocketed buyers from the Northeast and Midwest are entering Florida's market. Without this influx of out-of-state buyers willing to pay premium prices, Florida home values increasingly depend on local incomes—which often cannot support current price levels.

While Florida Realtors notes that "domestic in-migration [is] still above the long-term trend," the significant deceleration is already impacting market dynamics.

4. Interest Rate Environment

Mortgage interest rates remain a critical factor in Florida's housing market outlook. After peaking at 7.79% in October 2023, the typical rate for a 30-year fixed-rate mortgage hit a low point of 6.08% in September 2024, according to Ramsey Solutions.

Lawrence Yun, chief economist at the National Association of REALTORS®, projects that 30-year mortgage rates will stabilize around the 6% mark in 2025 and into 2026. While this represents an improvement from recent peaks, rates remain significantly higher than the sub-3% levels seen during the pandemic boom.

These elevated rates continue to strain affordability, particularly in Florida, where home prices remain near historic highs despite recent cooling.

5. Natural Disaster Vulnerability

Hurricane impacts have significantly affected regional housing markets throughout Florida. The Florida Realtors report notes, "Florida's housing market was disrupted by several hurricanes during [2024], from Hurricane Debby to the almost back-to-back devastation of Hurricanes Helene and Milton."

Markets like Cape Coral and Punta Gorda, which were hard-hit by Hurricane Ian in September 2022, have experienced particular softening. ResiClub Analytics says, "Hurricane Ian caused an estimated $112.9 billion worth of total damage, making Ian the third-costliest U.S. hurricane on record. This combination of increased housing supply for sale (i.e., the damaged homes), coupled with strained demand—resulting from spiked home prices, spiked mortgage rates, higher insurance premiums, and higher HOAs—has translated into market softening across much of Southwest Florida."

As climate concerns grow, the long-term impact on coastal property values remains a significant consideration for the Florida market.

Regional Analysis: Which Florida Markets Are Most Vulnerable?

The likelihood and severity of a potential housing correction vary significantly across Florida's diverse regions:

South Florida (Miami, Fort Lauderdale)

South Florida presents a complex picture. According to NBC Miami, "For Miami, we see in 2025 that the prices of homes will go up by 4%." However, this growth is primarily driven by luxury and high-end properties.

The Miami Herald reports, "South Florida's housing market is defying the odds. Sales prices for condos and single-family houses increased in November compared to a year ago as deals dropped and inventory increased. Prices continue to climb thanks to wealthy buyers buying on the high end, leading to big transactions that affect the overall numbers."

The condo market in South Florida faces particular challenges due to new structural safety requirements following the Surfside condo collapse in 2021. ResiClub Analytics notes that "following the Surfside condo collapse in June 2021, which killed 98 people, Florida passed new structural safety rules, requiring more inspections and additional funds for repairs to be set aside by the end of 2024. That has led to Florida HOAs issuing sky-high special assessments and monthly HOA fee increases."

Central Florida (Orlando, Tampa)

Central Florida is showing signs of market stabilization. According to Florida Trend , "Central Florida is seeing a balanced housing market for the first time in over a decade, according to the November report from the Orlando Regional Realtor Association. Rose Kemp, the ORRA president, said 2024 has been the year of stabilization in the area's housing market."

Orlando's median home price increased 1.4% year-over-year to $442,500, while Tampa saw a slight decrease of 1.2% to $410,000. The I-4 Corridor between Tampa and Orlando was one of the few bright spots for condo and townhouse sales, which actually grew in 2024 compared to 2023.

Southwest Florida (Cape Coral, Fort Myers)

Southwest Florida remains particularly vulnerable due to the lingering effects of Hurricane Ian and elevated insurance costs. ResiClub Analytics reports, "markets like Cape Coral and Punta Gorda, which were hard-hit by Hurricane Ian in September 2022, saw thousands of damaged homes and the subsequent need for renovations."

This region has experienced some of the state's most significant market softening, with both supply and demand factors contributing to price pressures.

Northeast Florida (Jacksonville)

Northeast Florida has shown relative stability compared to other regions. The median price of a single-family home in Northeast Florida rose 0.5% in November to $392,000, its fourth consecutive monthly increase, according to Florida Trend.

However, even in this more stable region, "inventories continued to climb while sales volume is down in the market that comprises Duval, Baker, Clay, Nassau, Putnam and St. Johns counties."

What This Means for Buyers and Sellers

For Potential Homebuyers

If you're considering buying a home in Florida, the market is increasingly moving in your favor. With inventory at decade-high levels and price growth slowing or reversing in many areas, buyers have more options and negotiating power than at any point since before the pandemic.

Ramsey Solutions suggests, "2025 should be a great time to buy a house in Florida if you're financially ready." However, they caution against waiting for further price drops or interest rate decreases: "There's no point in waiting around for interest rates to go down. If you're ready to buy, go ahead and get the ball rolling."

Key considerations for buyers include:

Be selective about location: Market conditions vary dramatically across Florida. Research local trends carefully before committing.

Factor in insurance costs: Insurance premiums have become a significant component of housing costs in Florida. Get insurance quotes before making an offer.

Negotiate aggressively: Sellers are increasingly willing to make concessions with homes staying on the market longer and inventory rising.

Consider new construction: With builders offering incentives like mortgage rate buydowns, new homes may offer better value than resale properties in some areas.

For Sellers

If you're planning to sell a Florida property, the window of opportunity may be narrowing. While not yet a buyer's market statewide for single-family homes, the trend is clearly moving in that direction.

Sellers should consider:

Price realistically: The days of aspirational pricing are over. Homes priced too aggressively are sitting on the market.

Act sooner rather than later: If inventory continues to climb and mortgage rates remain elevated, selling conditions may deteriorate further.

Be prepared to negotiate: Buyers have more options and are less likely to engage in bidding wars or waive contingencies.

Consider your next move: If you're selling to buy another Florida property, the same market conditions that challenge you as a seller may benefit you as a buyer.

Conclusion: Correction, Not Crash—But Timing and Location Matter

While Florida's housing market is unlikely to experience a catastrophic crash similar to 2008, a significant correction is already underway in many regions. The combination of skyrocketing insurance costs, inventory at decade-high levels, slowing migration, and elevated mortgage rates has fundamentally altered the market dynamics that drove Florida's housing boom.

The severity of this correction will vary dramatically by location. Coastal areas with high insurance costs and condo markets affected by new regulations face the most significant challenges.

Meanwhile, some inland areas and luxury markets may continue to see modest appreciation.

The more accurate question for those asking when Florida's housing market will crash might be whether the already begun correction will accelerate or stabilize. The data suggests that 2025 will be a pivotal year, with inventory expected to peak and the market firmly transitioning to favor buyers.

Rather than a sudden crash, Florida appears headed for a gradual rebalancing—one that may ultimately create a healthier, more sustainable housing market for the long term.

Frequently Asked Questions

Is Florida real estate overpriced?

Many analysts believe specific Florida markets became overpriced during the pandemic boom, with home values increasing by more than 50% between 2020 and 2022. This rapid appreciation outpaced income growth, creating an affordability gap. However, the degree of overvaluation varies significantly by region, with some areas already experiencing price corrections while others remain resilient.

Which Florida cities are most likely to see price drops?

Based on current data, the Florida markets most vulnerable to price drops include:

Coastal condo markets affected by new structural safety regulations and rising insurance costs

Southwest Florida communities still recovering from Hurricane Ian (Cape Coral, Fort Myers, Punta Gorda)

Areas with rapidly growing inventory and slowing sales (parts of Tampa Bay and Orlando)

Communities with the highest insurance premium increases

Should I wait to buy a house in Florida?

The decision to buy now or wait depends on your personal circumstances, financial readiness, and long-term plans. If you're financially prepared and find a property that meets your needs at an affordable price, 2025 offers more favorable buying conditions than recent years. However, waiting might be prudent if you're in a particularly vulnerable market or concerned about further price declines. Remember that timing the exact bottom of any market is nearly impossible.

Will Florida condo prices crash?

According to ResiClub Analytics, the Florida condo market is showing more weakness than the single-family home market, with prices already declining in 92% of Florida's housing markets. New structural safety regulations requiring regular inspections and adequate HOA reserve funds have increased fees and listings. While a dramatic crash is unlikely, continued price corrections in the condo market are probable throughout 2025, especially in older buildings facing significant assessment increases.

References

Florida Realtors. (2025, February 4). Florida Realtors 2025 Real Estate Trends: What's Ahead for Fla.'s Housing? PR Newswire. https://www.prnewswire.com/news-releases/florida-realtors-2025-real-estate-trends-whats-ahead-for-flas-housing-302367555.html

Ramsey Solutions. (2025, January 20) . Florida Housing Market Predictions 2025. https://www.ramseysolutions.com/real-estate/florida-housing-market

Newsweek. (2025, February 26) . Florida's Housing Market Reaches Troubling Milestone. https://www.newsweek.com/florida-housing-market-reaches-troubling-milestone-2036448

ResiClub Analytics. (2025, January 31) . From boom to correction: 5 reasons Florida's housing market has weakened. https://www.resiclubanalytics.com/p/from-boom-to-correction-5-reasons-florida-s-housing-market-has-weakened

NBC Miami. (2025, January 26) . These are the Zillow housing price predictions for 2025. https://www.nbcmiami.com/news/local/these-are-the-zillow-housing-price-predictions-for-2025/3522780/

Forbes. (2025, March 10) . Housing Market Predictions For 2025: When Will Home Prices Drop? https://www.forbes.com/advisor/mortgages/real-estate/housing-market-predictions/

Florida Trend. (2025) . Realtors release report detailing 2025 housing market predictions. https://www.floridatrend.com/article/42012/realtors-release-report-detailing-2025-housing-market-predictions/